VuxoCap 2026 Complete Review – Everything You Need to Know

VuxoCap enters the trading space with a tone that feels deliberately restrained. Rather than centring its message around rapid results or exaggerated claims, the platform consistently emphasises how trading decisions are made and executed. The focus is on clarity, preparation, and maintaining control across changing market conditions, which immediately sets expectations for how the platform should be used.

This review looks at VuxoCap from a practical perspective, starting with how the company frames its overall approach and then moving into a dedicated review of each supported market. The goal is not to oversell the platform, but to evaluate whether its structure, tools, and execution standards genuinely support disciplined trading behaviour. As briefly noted by our team at GLreviews, VuxoCap appears designed for traders who prefer consistency and process over constant stimulation.

An Overview of VuxoCap (User Experience: 8.9 / 10)

At the company level, VuxoCap positions itself around structure rather than speed. This philosophy is visible in both the platform’s layout and the way its features are introduced. Instead of encouraging frequent trading or pushing aggressive incentives, the platform focuses on providing a stable environment where traders can analyse, plan, and execute with fewer distractions.

Access to markets is unified under a single account, regardless of experience level. Account tiers are used to scale support and insights rather than restrict instruments, reinforcing the idea that informed decision-making should not depend on exclusivity.

Key elements of VuxoCap’s broader approach include:

- A single platform supporting five major global markets

- Interface design aimed at reducing visual and informational noise

- Secure infrastructure with segregated client funds

- Consistent execution standards across all asset classes

- Account structures focused on guidance rather than pressure

This foundation shapes how each individual market is handled on the platform and provides important context for the reviews below.

VuxoCap Forex Trading Review (8.5 / 10)

Forex trading on VuxoCap is presented as a market driven by liquidity, macroeconomic forces, and global participation rather than short-term speculation. Traders can access major and minor currency pairs with real-time pricing across key trading sessions, using tools that support structured analysis instead of constant activity.

Key aspects of the Forex trading scene at VuxoCap include:

- Access to major and minor currency pairs

- Stable pricing during high-liquidity market sessions

- Ability to trade both rising and falling currency markets

- Tools designed for macro and session-based analysis

- Forex trading is available within the main multi-asset account

What stands out is how Forex trading is framed as a market that rewards preparation. The platform does not push traders toward frequent position changes or rapid execution for its own sake. Instead, it provides an environment where economic data, central bank decisions, and broader trends can be assessed calmly before trades are placed.

VuxoCap Stock Trading Review (8.5 / 10)

Stock trading on VuxoCap is built around analysis, patience, and deliberate execution. Traders can access a range of global equities and approach opportunities through earnings data, sector performance, and broader market behaviour. The platform’s layout supports this process by keeping execution tools clear and separate from analytical views.

Key aspects of stock trading at VuxoCap include:

- Access to a broad selection of global equities

- Support for both long and short stock positions

- Real-time pricing and clear order execution

- Tools that support earnings and trend analysis

- Integrated risk management across positions

Rather than presenting stock trading as a fast-moving activity driven by headlines, VuxoCap encourages a more measured approach. The structure of the platform makes it easier to evaluate setups, define risk, and execute trades with intention.

VuxoCap Commodities Trading Review (8.7 / 10)

Commodities trading on VuxoCap is shaped around markets influenced by supply, demand, and global macroeconomic conditions. Traders can access key commodities such as metals, energy products, and agricultural instruments, all within the same trading environment used for other asset classes.

Key aspects of commodities trading at the platform include:

- Access to metals, energy, and agricultural markets

- Real-time pricing driven by global supply dynamics

- Tools for managing exposure in volatile conditions

- Ability to trade both upward and downward price movements

- No separate account required for commodity markets

The platform presents commodities as data-driven markets rather than speculative instruments. By focusing on fundamentals such as production cycles, geopolitical developments, and global demand, VuxoCap supports a more analytical approach to commodity trading.

VuxoCap Crypto Trading Review (9 / 10)

Crypto trading on VuxoCap reflects the platform’s broader emphasis on control, even in markets that operate continuously. Cryptocurrency markets are available around the clock, including weekends, and the platform provides real-time pricing and responsive execution without encouraging constant engagement.

Key aspects of crypto trading include:

- Access to leading cryptocurrencies

- Continuous market availability, 24/7

- Fast execution during periods of heightened volatility

- Tools focused on position management and risk control

- Crypto trading is integrated into the main account structure

While crypto markets are often associated with rapid movement and emotional decision-making, VuxoCap approaches them in a more restrained way. The platform’s design encourages traders to manage exposure carefully and remain consistent in their approach, even when volatility increases.

VuxoCap Indices Trading Review (9.1 / 10)

Indices trading on VuxoCap allows traders to focus on broader market direction rather than individual company performance. By trading major global indices, users gain exposure to overall economic sentiment across regions and sectors through a single instrument.

Key aspects of indices trading include:

- Access to major global market indices

- Exposure to broad economic and market trends

- Simplified execution compared to single-stock trading

- Support for both rising and falling index markets

- Consistent execution standards across index instruments

This market fits naturally into VuxoCap’s structured philosophy. Indices trading encourages a top-down perspective, where traders assess macro conditions and overall sentiment rather than isolated data points.

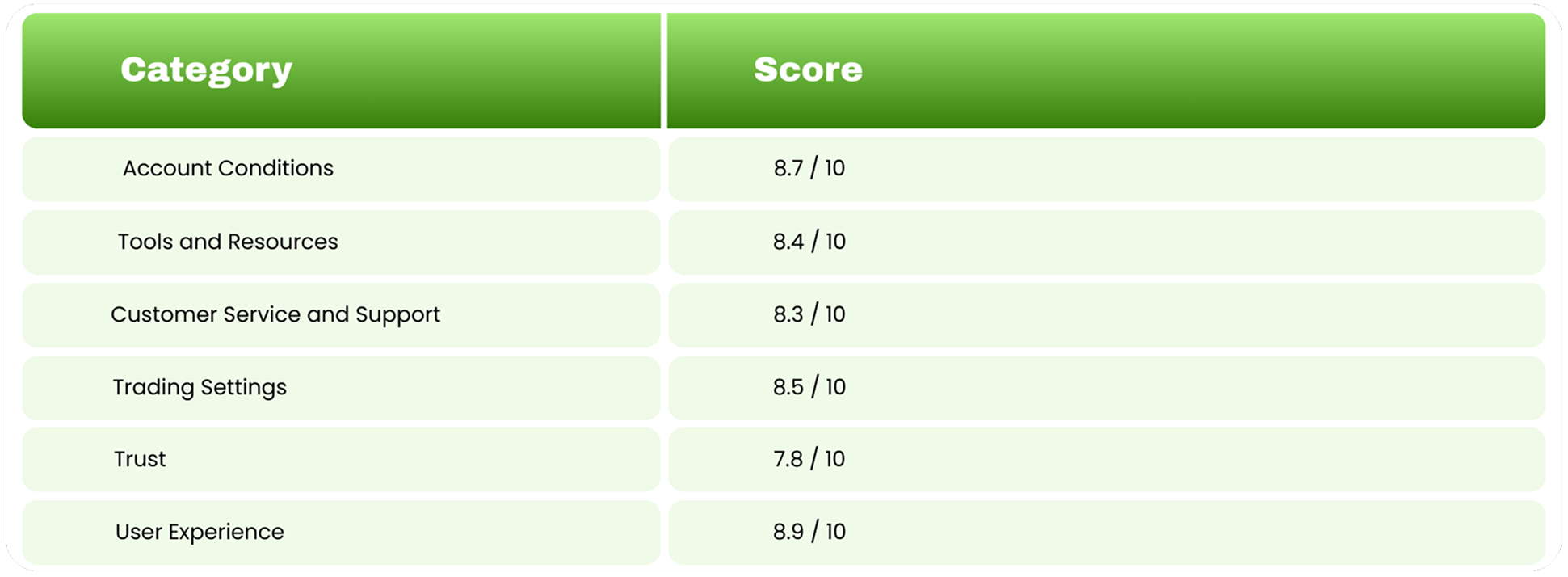

VuxoCap Scores and Ratings (2026)

Below is a structured scoring breakdown based on platform usability, feature analysis, and trader-focused evaluation criteria. These scores reflect real-world usability and clarity, not marketing claims.

How these scores are determined:

Ratings are based on six weighted categories: transparency of costs, quality of tools and resources, support responsiveness, trading conditions, trust signals and policies, and overall usability. Greater weight is given to factors that directly affect real trading outcomes, such as execution reliability, clarity of fees, and ease of risk management.

For those who prefer a cleaner way to express market views without managing multiple individual positions, the indices offering provides a practical and disciplined alternative.

VuxoCap – Full Market Coverage Overview

VuxoCap Account Types Explained (Account Conditions: 8.7 /10)

VuxoCap structures its account offering around trader experience, capital commitment, and support needs rather than restricting access to markets. All account types provide access to the same five asset classes, while differences focus on leverage, analytical support, and personal assistance. This approach keeps the learning curve consistent while allowing traders to scale their setup as their needs evolve.

Let’s learn more about the individual account types offered on VuxoCap!

Essential Account – from $1,500

The Essential account is intended as a structured entry point for traders who want access to global markets without unnecessary complexity. It includes the platform’s core tools, risk management features, and dedicated support, making it suitable for traders who are still developing consistency.

This account works well for those who want to focus on learning platform mechanics, building disciplined habits, and trading with clearly defined exposure rather than higher leverage or advanced add-ons.

Advanced Account – from $25,000

The Advanced account introduces additional analytical resources designed for more active traders. Alongside full market access, users receive monthly market analysis reports and technical assistance that can help contextualise broader market movement.

This tier is generally better suited to traders who already have a strategy in place and want structured insights to support their own analysis without relying on constant external signals.

Elite Account – from $50,000

The Elite account is positioned for experienced traders seeking greater flexibility and deeper market engagement. Higher leverage limits and more frequent insights are included, allowing traders to manage positions with a broader range of strategic options.

Rather than changing how the platform functions, the Elite account enhances the level of information and responsiveness available, which can be useful for traders managing more complex portfolios or trading across multiple markets simultaneously.

Premier Account – from $100,000

The Premier account adds a more personalised layer to the trading experience. In addition to advanced insights and higher leverage, users receive tailored account assistance, faster market access, and instant trade notifications.

This account is designed for traders who value efficiency and direct support, particularly when managing larger positions or trading during active market periods where timing and execution consistency matter.

Private Account – Custom Deposit

The Private account is aimed at professional or high-volume traders who require customised trading conditions. Features include protected trades on a monthly basis, bespoke account setup, and enhanced personal support.

Rather than offering a predefined structure, this account adapts to the trader’s specific requirements, making it suitable for those with established processes who want the platform to align closely with their existing workflow.

VuxoCap Account Comparison Overview

The table below summarises all account types on VuxoCap, highlighting how each tier differs in terms of capital requirements, leverage, and support, while maintaining consistent market access across the platform.

| Account Type | Minimum Deposit | Leverage | Market Access | Analytical Support | Personal Assistance | Additional Features |

| Essential | $1,500 | Up to 1:25 | Forex, Stocks, Commodities, Crypto, Indices | Introductory education | Dedicated support | Core risk management tools |

| Advanced | $25,000 | Up to 1:25 | All markets | Monthly market analysis reports | Dedicated support | Technical assistance |

| Elite | $50,000 | Up to 1:50 | All markets | Monthly reports + weekly insights | Dedicated support | Higher leverage, enhanced flexibility |

| Premier | $100,000 | Up to 1:50 | All markets | Monthly reports + weekly insights | Personalised account assistance | Faster market access, instant notifications |

| Private | Custom | Up to 1:50 | All markets | Full analytical access | Fully personalised support | Protected trades, custom trading profile |

This comparison highlights that VuxoCap does not gate market access behind higher deposits. Instead, account progression focuses on support depth, leverage flexibility, and workflow efficiency, allowing traders to scale without changing platforms or relearning tools.

The VuxoCap Testimonials (User Reviews: 8.9 / 10)

Feedback from traders across different experience levels consistently highlights the platform’s structured feel and calm trading environment. Rather than focusing on outcomes, many users emphasise how the platform influences their behaviour and decision-making process.

Some recurring themes from user feedback include:

- Reduced distraction during analysis and execution

- Easier management of multiple markets from one interface

- Consistent execution during volatile market conditions

- Greater emphasis on planning and patience

Selected trader perspectives include:

“VuxoCap has helped me simplify my trading process. Everything feels more structured, which has improved my consistency.”

“The platform removes unnecessary distractions and keeps the focus on decision-making.”

“Trading on VuxoCap feels deliberate. From analysis to execution, the workflow supports disciplined trading habits.”

“Execution has been reliable, even during volatile sessions. That consistency matters.”

“The platform encourages patience, which has improved how I manage risk and avoid overtrading.”

Rather than portraying the platform as a performance tool, these comments reflect how VuxoCap supports a more controlled and methodical trading approach.

Additional Platform Resources and Tools (8.5 / 10)

Beyond trading and account structures, VuxoCap includes several supporting resources accessible through its main navigation. These features are designed to complement the trading experience rather than distract from it.

- VIP Account Access – Information on premium-level services and personalised trading support

- Blog – Market-focused articles and platform updates

- AI Trading – Educational content related to algorithmic and data-driven trading concepts

- Mobile Trading – Full platform access across mobile devices

- Deposits & Withdrawals – Clear processes for funding and managing account balances

- Glossary – Explanations of key trading terms and concepts

These sections reinforce the platform’s educational and structural focus, providing context and support without pushing traders toward unnecessary activity.

Conclusion

VuxoCap presents a clear alternative to platforms built around speed, volume, or constant stimulation. Its emphasis on structure, consistent execution, and unified market access makes it particularly well-suited to traders who value preparation and control over rapid decision-making. Across its markets and account tiers, the platform remains focused on process rather than outcomes, offering tools that support disciplined participation rather than encouraging overtrading.

For traders seeking a multi-asset platform that prioritises clarity, scalability, and a measured trading environment, VuxoCap stands out as a thoughtfully constructed option rather than a promotional one.

Frequently Asked Questions About VuxoCap

Now, let’s have a look at some of the most frequently asked questions VuxoCap has received from various traders across the world!

What is VuxoCap, and how does it differ from other trading platforms?

VuxoCap is a multi-asset trading platform designed around structure, clarity, and disciplined execution. Unlike platforms that emphasise frequent trading or promotional incentives, VuxoCap focuses on providing a stable environment that supports planning, risk management, and consistent decision-making.

What markets can I trade on VuxoCap?

VuxoCap provides access to five major markets: Forex, Stocks, Commodities, Cryptocurrencies, and Indices. All markets are available from a single account, using the same interface and execution standards.

Do I need separate accounts for different markets?

No. One of VuxoCap’s core strengths is its unified account structure. Traders can access all supported markets from a single account without switching platforms or opening additional profiles.

Is VuxoCap suitable for beginners?

VuxoCap can be suitable for beginners who value structure and a slower learning curve. The Essential account provides access to all markets alongside risk management tools and support, without introducing unnecessary complexity or pressure to trade frequently.

Can I trade both rising and falling markets?

Yes. Across all supported asset classes, VuxoCap allows traders to take positions that benefit from both upward and downward price movement, enabling flexible strategies across different market conditions.

Is the platform available on mobile devices?

Yes. VuxoCap supports multi-device access, allowing traders to monitor markets, manage positions, and execute trades from desktop or mobile using the same account credentials.

Does VuxoCap provide trading advice or signals?

VuxoCap does not position itself as a signal-based platform. While higher-tier accounts include market insights and analysis reports, these are intended to support independent decision-making rather than replace it.

Quick Links

Latest Posts

Stay informed with our latest articles covering trading basics, market insights, and platform reviews.

-

Forex vs Crypto Trading – Market Comparison

Forex vs crypto trading is one of the most searched comparisons…

-

Bitcoin vs Ethereum – Full Comparison & Breakdown

Bitcoin vs Ethereum is one of the most searched and discussed…

-

A Full Guide to Support and Resistance Zones in Trading

Support and resistance zones form one of the most widely used…

-

Qu’est-ce que l’effet de levier en trading – Guide complet pour débutants

Ce qu’est l’effet de levier en trading semble souvent déroutant pour…

-

Qu’est-ce qu’une taille de lot en trading – Guide pour débutants

Ce qu’est une taille de lot en trading est l’un des…

-

Comment acheter et vendre du Bitcoin en toute sécurité – Guide pour débutants

Comment acheter et vendre du Bitcoin en toute sécurité est l’une…